The payments industry is ever-evolving and card brands are frequently implementing changes to make the payments space more secure. Visa recently rolled out some significant changes to their chargeback and fraud programs in the fall of 2019, which you can read about in our blog post. Now, Mastercard is implementing some changes of their own regarding their monitoring programs. This blog is meant to keep merchants updated of these changes and provide a comprehensive source for Mastercard chargeback and fraud programs, along with upcoming changes that may impact your account.

Overview

Effective October 2019, Mastercard is implementing a brand-new fraud monitoring program, called the Excessive Fraud Merchant Compliance Program (EFM). The goal of this program is to reduce the amount of ecommerce fraud globally.

Mastercard’s chargeback monitoring program is called the Excessive Chargeback Program (ECP). It contains two tiers of program thresholds (CMM and ECM) and your account will fall into one or the other, depending on the severity of the chargeback issue. Just as with their fraud program, the goal of this program is to reduce chargebacks -- due to either fraud or consumer dispute reasons -- and improve the payment experience. This program is not new and there are no changes to this program at this time.

Excessive Fraud Merchant (EFM)

Mastercard identifies merchant activity at the merchant account level. If a merchant account meets the following conditions in a calendar month, they can be placed in the EFM program:

- At least 1,000 Mastercard sales transactions in the previous month

- At least $50,000 in Mastercard fraud chargebacks under reason codes:

- 4837 (No Cardholder Authorization)

- 4863 (Cardholder Does Not Recognize -- Potential Fraud)

- At least 0.50% fraud chargebacks-to-sales ratio

- Less than 10% of volume passing through 3D Secure in non-regulated countries or less than 50% of volume passing through 3D Secure in regulated countries

Non-regulated countries refers to countries without a legal or regulatory requirement for strong cardholder authentication (e.g. US, Canada, some European countries). Regulated countries refers to countries with legal or regulatory requirements for strong cardholder authentication (e.g. some European and APAC countries).

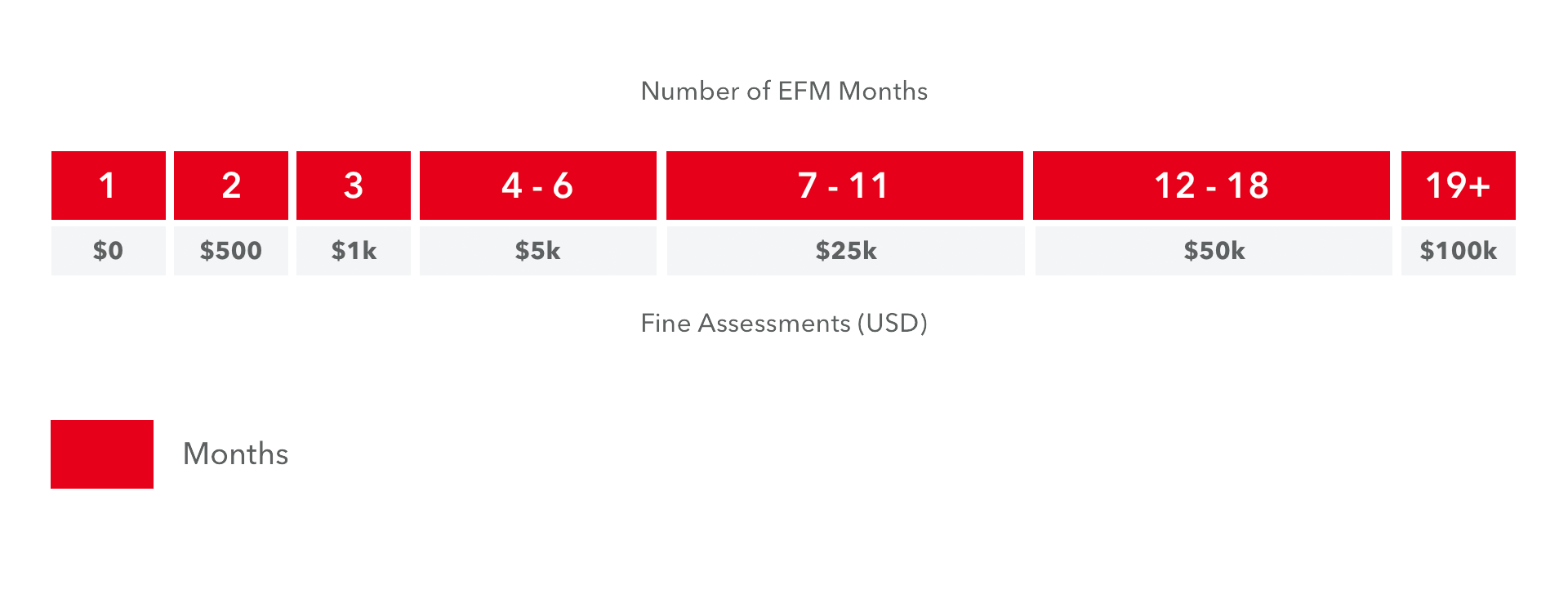

Once in the EFM program, the account is eligible for the fines as shown in the table below. However, while the program is rolling out in October 2019, Mastercard will not start assessing these fines until March 2020 for most regions. The exception is Canada, who will not receive fine assessments until October 2020.

To be removed from the EFM program, a merchant must be in compliance for three consecutive months, meaning the account did not meet the criteria listed above to be flagged in the program. Once a merchant exits the EFM program, any subsequent flagging would start over at Month 1 again. While enabling 3D Secure is not a requirement of this program, it is recommended to help mitigate fraud by authenticating transactions.

Excessive Chargeback Program (ECP)

Just as with the EFM program, merchants are identified in the Mastercard chargeback program at the merchant account level. Mastercard calculates chargeback ratios by taking the total number of first chargebacks received in a given calendar month and dividing it by the prior month’s sales.

For example: June’s chargebacks / May’s sales

There are two different thresholds in Mastercard’s ECP program in which a merchant could be identified. Those are:

Chargeback Monitored Merchant (CMM)

A merchant can be placed in the CMM program when the following criteria is met in a calendar month:

- First chargebacks received: 100

- Chargeback-to-sales ratio: 1.0%

There are no fine assessments at the CMM level.

Excessive Chargeback Merchant (ECM)

A merchant can be placed in the ECM program when the following criteria is met in a calendar month:

- First chargebacks received: 100

- Chargeback-to-sales ratio: 1.5% for two consecutive months

Mastercard can assess fines the first month a merchant enters the ECM program. These fines are assessed at the discretion of Mastercard and, in general, can be up to the total amount of Mastercard confirmed chargebacks in the ECM identification. For example, if your account had $5,000 in confirmed Mastercard chargebacks in your ECM identification, this fine would not exceed $5,000.

To be removed from the ECP, a merchant must be below CMM thresholds, which is 100 chargebacks and 1.0% chargeback to sales ratio, for two consecutive months. Once a merchant exits the ECP they begin a clean slate, and any subsequent flaggings would start their standings from the beginning.

Other considerations

If a merchant breaches the thresholds for both the Excessive Fraud Merchant (EFM) program and the Excessive Chargeback Program (ECP), they would be entered into the EFM program and not the ECP.

For merchants that have their merchant accounts through Braintree, our Disputes team will notify you if you’re flagged in any of the above programs, work with you to reduce the chargeback or fraud activity, and remediate your account out of the program. You can read more about this process in our blog post.

Mastercard may request a remediation plan along with any of these program identifications. The purpose of a remediation plan is to show Mastercard that steps are being taken to mitigate fraud and chargebacks. We’ll ask for the following details, but you may also share any additional information you find pertinent to the activity:

- Business Description

- Events leading to the increased chargeback and fraud

- Actions taken to reduce chargebacks and fraud, including implementation dates

- Description of all fraud tools currently enabled

Common Questions

How does Mastercard calculate fines for the ECP?

Fines can be assessed the first month the account reaches ECM thresholds. The formula is:

$100 Reporting Fee + Issuer Recovery + Violation Assessment

This means there is no set fine amount for each ECM identification. However, the fine assessment will not be more than the total amount disputed in the ECM identification as referenced above.

How can I calculate my Mastercard chargeback ratio?

Check out our blog post that reviews how merchants can calculate their ratios, and how Braintree can help reduce them.

Why do my numbers vary from what Mastercard reported?

Chargeback numbers displayed in the Control Panel are considered estimates, as these will differ from the card network’s official figures due to multiple factors, including but not limited to timing differences in reporting, auto-representation, and multiple merchant processors.

Do won chargebacks count against my Mastercard ratio?

Yes. Regardless of outcome, if a chargeback opens, it is counted against the ratio.

Are pre-arbitrations and retrievals counted in the ECP?

No. Only first chargebacks count against the ratio.

Do chargebacks received on already refunded transactions count towards my ratio?

Yes. If a chargeback opens against any transaction, it is counted against the ratio, even if the transaction was previously refunded.

Some of the chargebacks I received this month were on transactions processed months ago. What month are these counted in my chargeback count?

Chargebacks are counted in the month they are raised, not when the transaction was processed. Many times, chargebacks are raised in the months after they were processed.

Are the program fines included in my Braintree chargeback fee?

No. Program fines issued by Mastercard are supplemental fees which are not included in the chargeback fee.

Can I change how Mastercard calculates my chargeback and fraud rates?

No. By choosing to process Mastercard credit and debit cards, merchants agree to their mandated rules and regulations.

If you have any questions, reach out to us at any time.